Travel Insurance Medical Expense Cra

Where public transportation is not readily available you may be able to claim vehicle expenses instead. Many people may be surprised to learn that travel medical insurance is tax deductible as a medical expense.

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

Medical Travel Ambulances have a reputation for being expensive however they are an eligible medical expense.

Travel insurance medical expense cra. The following CRA document should help. Fortunately Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax. Thankfully depending upon how far you have to go for your care the government of Canada may allow you to claim medical expense travel credits.

Maybe you had to travel at least 40 kilometres one way from your home to get medical services. Note that the simplified method meal rate is increased to 23 per meal from 17 effective Jan 1 2020. The eligibility for a credit medical expenses are not available as a deduction are contained in s1182 2 q as you mentioned.

Medical aids including wheelchairs hearing aids and batteries eyeglasses contact lenses crutches braces and guide dogs and their care. This tax credit can also be claimed for your spouse common-law partner and children under 18 years of age. Make sure however that the plan meets the definition of a PHSP outlined in the document.

If you have travel expenses related to medical services and you also qualify for northern residents deductions line 25500 of your tax return you may be able to choose how to claim your expenses. 2007-0229901E5 discusses the eligibility of medical travel insurance premiums for purposes of the medical expense credit. Nov 13 2017 Dear Bird Talk As usual I read CSANews from cover to cover for its valuable information and advice concerning travel and medical insurance during our annual stay in Florida for the winter months.

If so you may be able to claim the public transportation for example taxi bus and train expenses you paid. Many of the expenses that you may incur to travel for medical treatment or expenses that you incur. And if you are one of our more than 80000 subscribers to Medoc Travel Insurance a part of these premiums may also be eligible to be claimed as medical expenses on line 330 or line 331 of Schedule 1 of your Federal Tax return.

Only certain travel expenses qualify. Contact lenses including equipment and materials for using contacts. Travel expenses at least 40 km the cost of the public transportation expenses for example taxis bus or train when a person needs to travel at least 40 kilometres one way but less than 80 km from.

Travel Health Insurance is a Tax Deductible Expense and more Posted date. See the CRA web page on travel expenses for medical expense which links to information on meal and vehicle rates used to calculate travel expenses for medical travel for each province. If a medical practitioner certifies in writing that you were not able to travel alone to get medical services you can also claim the transportation and travel expenses of an attendant.

In most cases your trip must be for medical or business purposes to claim a deduction. That confirmation document also acts as your income tax receipt. Canadian travellers may be eligible to get some money back for travel medical insurance premiums.

Operating expenses such as fuel oil tires licence fees insurance maintenance and repairs ownership expenses such as depreciation provincial tax and finance charges Keep track of the number of kilometres you drove in that time period as well as the number of kilometres you drove specifically for the purpose of moving or medical expenses. The medical expense tax credit is one of the most overlooked non-refundable tax deductions. When you receive you travel insurance confirmation documents dont just save the wallet cards and throw the rest away.

The Canada Revenue Agency CRA offers a range of out-of-country travel deductions to offset the expenses involved with international journeys. Travel expenses less than 40 km travel expenses cannot be claimed as a medical expense if you traveled less than 40 kilometres one way from your home to get medical services. Travel insurance can be expensive particularly if you travel for extended periods of time have pre-existing health conditions or are a more mature traveller.

Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses. Insurance premiums for medical care coverage. In addition patients can claim a deduction for medical travel if they are unable to seek care for their conditions within 40 kilometers of their home.

Travel expenses to receive medical care outside your community. The CRA allows you to claim reasonable transportation and travel costs for a companion but only if your doctor has certified in writing that your condition makes you unable to travel by yourself. Can you claim travel expenses.

Your Travel Medical Insurance Premium Is Eligible For A Tax Credit Snowbird Advisor

Your Travel Medical Insurance Premium Is Eligible For A Tax Credit Snowbird Advisor

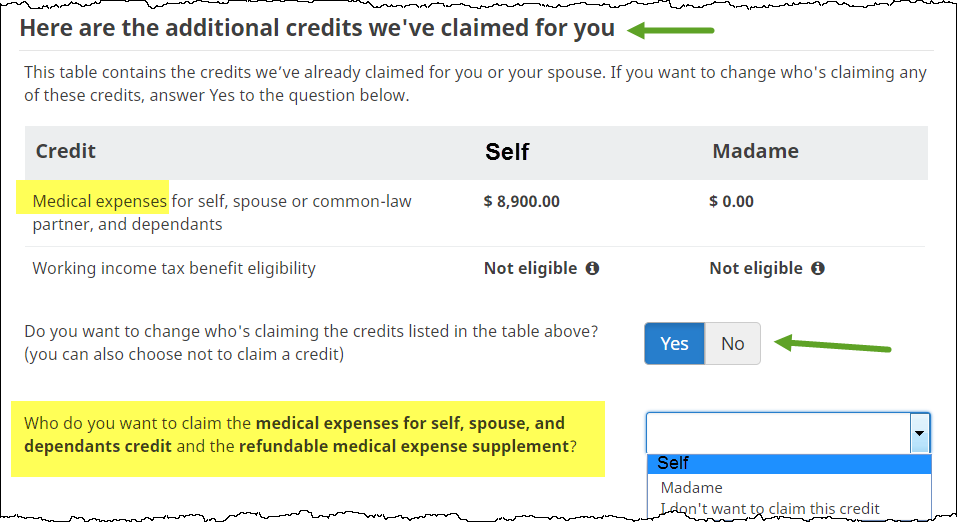

Http Intuitglobal Intuit Com Delivery Cms Prod Sites Default Education Intuit Ca Downloads Profile Profile 2018 Ch5 Pdf

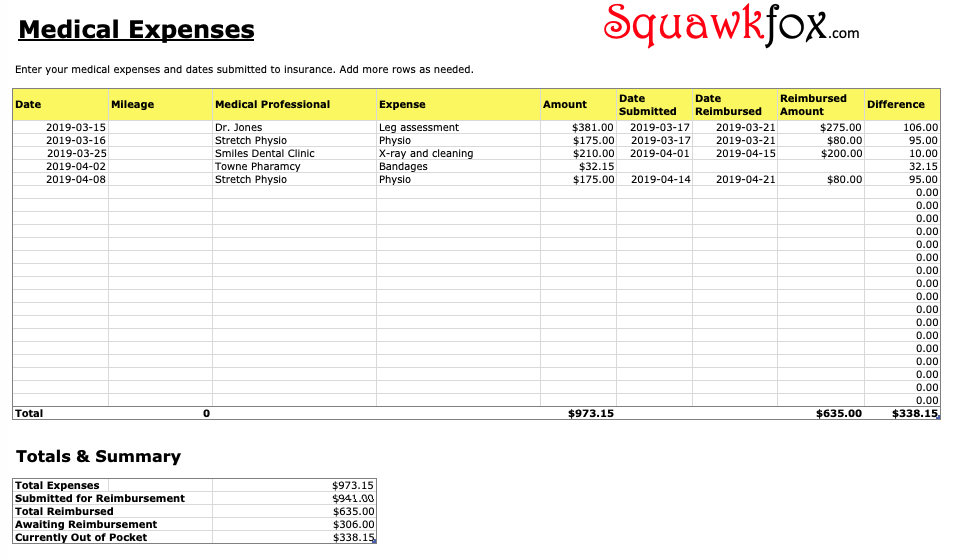

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox

How To Claim Medical Travel Expenses

How To Claim Medical Travel Expenses

What Can Independent Contractors Deduct

Calameo Tips To Cash In On Medical Expense Tax Credits Of The Harver Group Your Health Insurance Counter Fraud Services Tokyo

Calameo Tips To Cash In On Medical Expense Tax Credits Of The Harver Group Your Health Insurance Counter Fraud Services Tokyo

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Claiming Your Dependant S Medical Expenses H R Block Canada

Claiming Your Dependant S Medical Expenses H R Block Canada

Medical Expenses H R Block Canada

Medical Expenses H R Block Canada

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Medical Expenses Often Overlooked As Tax Deductions Cbc News

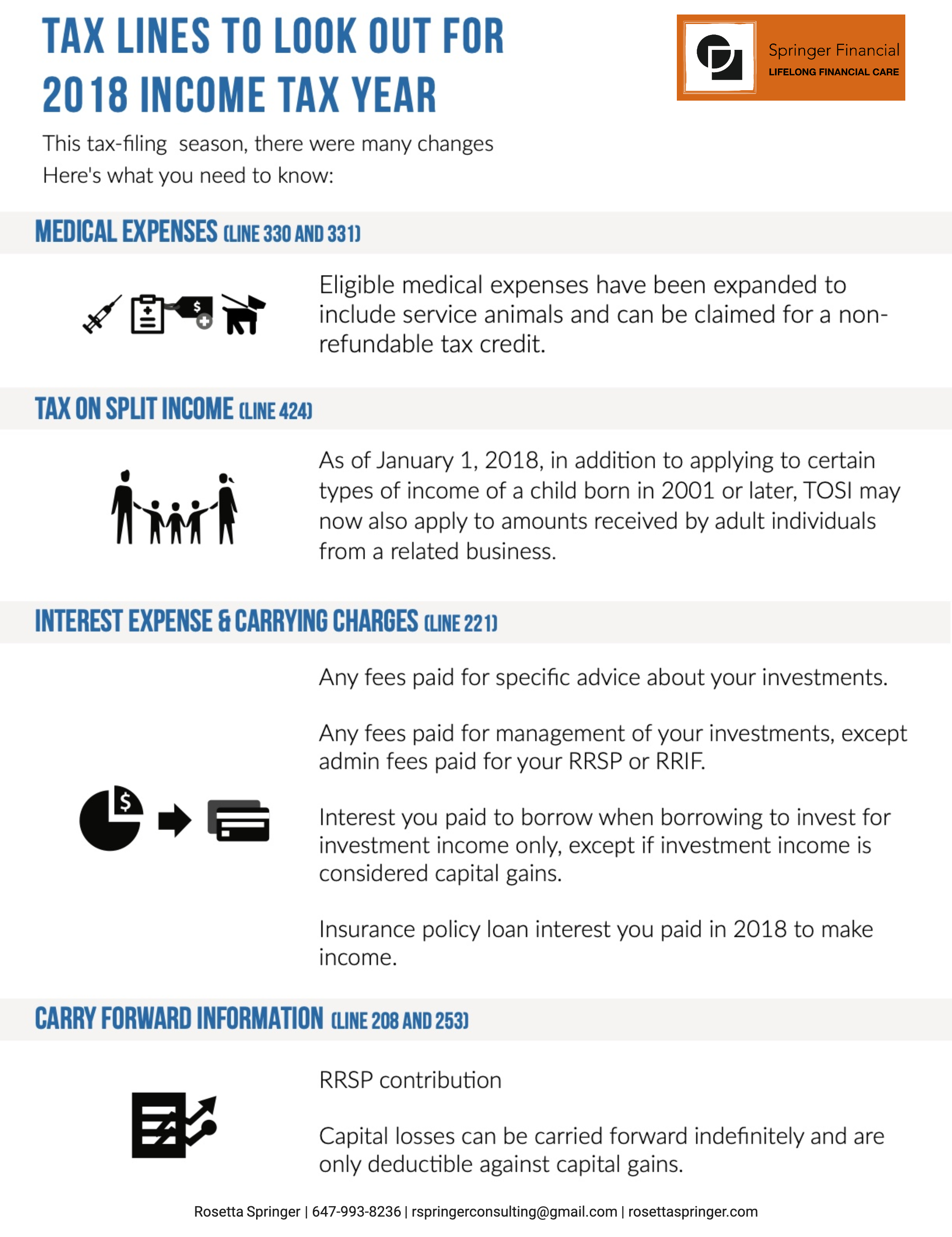

Tax Lines To Look Out For 2018 Income Tax Year

Tax Lines To Look Out For 2018 Income Tax Year

Does Medical Travel Insurance Qualify As A Medical Expense Credit Hutcheson Co

Does Medical Travel Insurance Qualify As A Medical Expense Credit Hutcheson Co

Two Simple Tips On Tax Savings Over Holiday Season Tax Money Savings Budget Adventure Travel Blog For Working Canadians

Reduce The Cost Of Your Travel Medical Insurance By Claiming A Tax Credit

Reduce The Cost Of Your Travel Medical Insurance By Claiming A Tax Credit

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Which Medical Expenses Are Not Eligible

Which Medical Expenses Are Not Eligible

Calameo The Harver Group Your Health Insurance Counter Fraud Services Tokyo

Calameo The Harver Group Your Health Insurance Counter Fraud Services Tokyo

How And What You Can Claim Your Business Expenses On Your Taxes As A Blogger Canada Save Spend Splurge

How And What You Can Claim Your Business Expenses On Your Taxes As A Blogger Canada Save Spend Splurge

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox

Post a Comment for "Travel Insurance Medical Expense Cra"