Travel Expenses Two Year Rule

To qualify as a temporary workplace there are a few criteria. Travel for necessary attendance.

Excel Spreadsheets Help Travel Expense Report Template Excel Spreadsheets Report Template Spreadsheet Template

Excel Spreadsheets Help Travel Expense Report Template Excel Spreadsheets Report Template Spreadsheet Template

This is known as the 24-month rule In practice if a contractor is going to spend more than two days out of five during a typical working week on a clients site then they have to work to the 24-month rule.

Travel expenses two year rule. In a nutshell the 24 month rule allows contractors to claim travel expenses between their home and their clients premises so long as it is classified as a temporary workplace. Requirement travel expenses not subject to income tax if the assignment is expected to last less than one year and does in fact last less than one year. The 24 month rule is a regulation introduced by HMRC that attempts to clarify a workers right to claim travel and subsistence expenses.

Or the contract is for more than two years but you spend less than 40 of your time at the site. All ships that sail are considered cruise ships. If an assignment is extended for which it will then.

For a workplace to be temporary at the start of your contract your contract needs to be less than 24 months and you need to be planning to work in a series of. How the 24-month rule. If the contractor exceeds the 40 rule then as long as they dont expect to work at that location for more than two years then they can continue to claim travel expenses.

According to the IRS if it is the employees choice to live away from his or her regular workplace tax home then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee. Must allocate travel time on a daily basis only deducting expenses for days spent on business activities. You cant deduct expenses that are lavish or extravagant or that are for personal purposes.

The IRS has long ruled that duplicate expenses have no bearing on the determination of the tax home. You might also have problems with IR35 after a couple of years in the same place. EIM32075 - Travel expenses.

For those jumping into contracting from permanent roles these classifications should sound familiar. But if you only spend one day out of the five-day trip conducting businessor just 20 of your time awayyou would only be able to deduct 20 of the cost of your airfare because the trip no longer qualifies as. A taxpayer is not considered away from home however if the assignment exceeds one year.

The 24 month rule has been in effect since 1998 and allows travel expenses to be claimed from your home to your clients site as long as it is classed as a temporary workplace. This basic guide should give you all you need to understand travel expenses to your clients site whist applying this rule. They will deem that you are a permie employee because have been there for so long.

Travel for necessary attendance. Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than. With regards to seasonal employees if the employee is assigned to the same general location two years in a row or would otherwise meet the one-year rule per diem would be considered compensation.

Limited duration the 24 month rule. In addition to its complexity the existing two-year process for calculating taxes on relocation expenses creates a burden for many lower-grade transferees because they are more likely to be required in the second year to repay an over-reimbursement in the first year. By doing a short contract you could reset it but it all depends on the length of the short contract.

Travel expenses are deductible under that Code provision only if the taxpayer is traveling away from home in the pursuit of a trade or business. The key factor for determining tax relief status within the 24 month rule lies in two different classifications of workplace. If you spend two days conducting business you can deduct the entire cost of the airfare as a business expensebecause two days out of five is equivalent to 40 of your time away.

511 Business Travel Expenses. Journeys to from your home to a temporary workplace are allowable if the contract is expected to be for less than two years. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job.

Special rules for conventions and cruises A taxpayer can deduct up to 2000 per year of expenses for attending conventions seminars or similar meetings held on cruise ships. This two year rule is applied on intent. Temporary workplace You should check the other guidance available on GOVUK from HMRC as Brexit updates to those pages are.

This is quite correct you cannot claim travel expenses after 2 years. EIM32080 - Travel expenses.

How To Calculate Travel Expenses For Businesses Travelperk

How To Calculate Travel Expenses For Businesses Travelperk

Business Travel Expense Report Template Small Business Expenses Expense Sheet Spreadsheet Business

Business Travel Expense Report Template Small Business Expenses Expense Sheet Spreadsheet Business

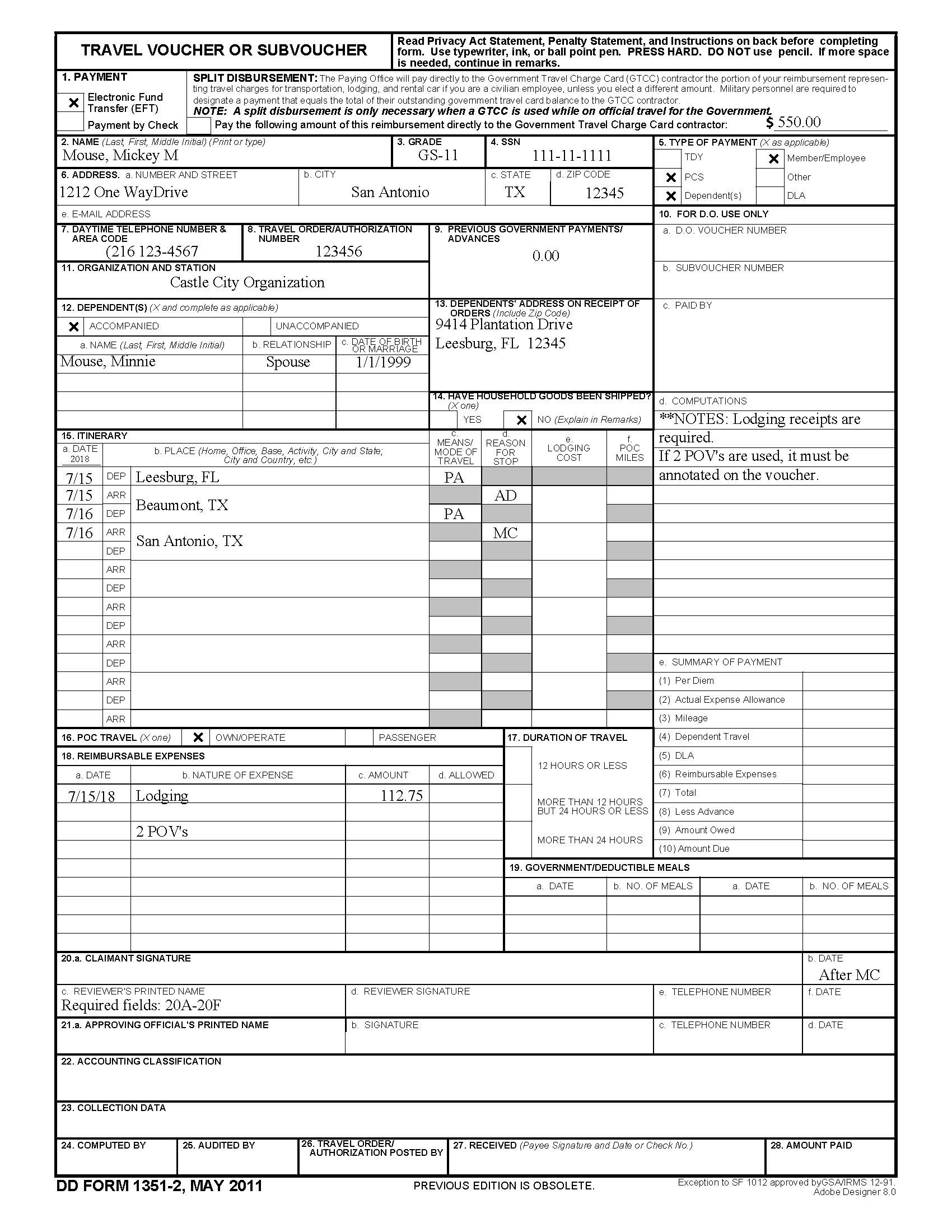

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide En Route Travel

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide En Route Travel

Https Www Hrblock Com Tax Center Wp Content Uploads 2016 03 Hr Block Tti Business Travel Deductions Pdf

Expense Reimbursement Policy Best Practices And 3 Templates

Expense Reimbursement Policy Best Practices And 3 Templates

How To Save 10 000 In 6 Months For Your Dream Vacation Monthly Budget Personal Finance Budget Budgeting

How To Save 10 000 In 6 Months For Your Dream Vacation Monthly Budget Personal Finance Budget Budgeting

Https Www Irs Gov Pub Irs Drop Rr 03 106 Pdf

How Landlords Can Deduct Rental Property Travel Expenses Millionacres

How Landlords Can Deduct Rental Property Travel Expenses Millionacres

Start A Simple Business To Pay Less Taxes And Contribute More To Pre Tax Retirement Accounts Small Business Tax Business Expense Business Tax

Start A Simple Business To Pay Less Taxes And Contribute More To Pre Tax Retirement Accounts Small Business Tax Business Expense Business Tax

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

How Landlords Can Deduct Rental Property Travel Expenses Millionacres

How Landlords Can Deduct Rental Property Travel Expenses Millionacres

.svg)

Pin By Sylvia Christopher On Travel American Travel Yurt Camping Yellowstone

Pin By Sylvia Christopher On Travel American Travel Yurt Camping Yellowstone

Https Www Irs Gov Pub Irs News Fs 06 26 Pdf

Big Money A Professional S Guide To Financial Freedom Financial Freedom Big Money Financial

Big Money A Professional S Guide To Financial Freedom Financial Freedom Big Money Financial

Post a Comment for "Travel Expenses Two Year Rule"