Travel Medical Insurance Tax Deductible Canada

This one simple tip could help many people fit their travel insurance expenses into their overall yearly budget. Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses.

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Retu Small Business Tax Deductions Business Tax Deductions Business Tax

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Retu Small Business Tax Deductions Business Tax Deductions Business Tax

Furthermore any premium contribution or other consideration including sales and premium taxes that you pay to a private health services plan.

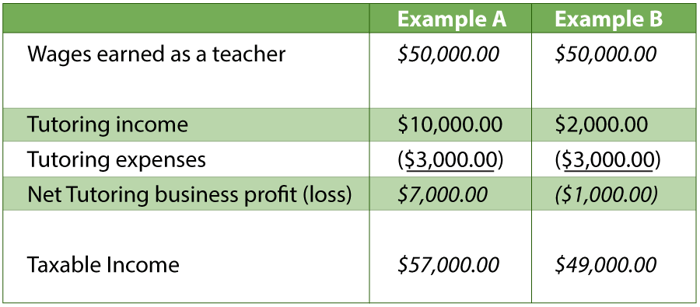

Travel medical insurance tax deductible canada. To determine the amount you can claim for vehicle expenses multiply the number of kilometres by the centskm rate from the chart below for the province or territory in which the travel begins. After completing the Self-Employed Health Insurance Deduction Worksheet in the Instructions for Forms 1040 and 1040-SR she can only deduct 4000 on Form 1040 or 1040-SR. Medical Expense Tax Credits allow you to reduce your income tax liability by claiming travel medical insurance premiums and other eligible medical expenses on your tax return and meeting certain.

2007-0229901E5 discusses the eligibility of medical travel insurance premiums for purposes of the medical expense credit. If you take a trip that begins and ends in one year and you are reimbursed the following year you cannot claim the deduction for travel benefits for that trip. The medical expense tax credit is one of the most overlooked non-refundable tax deductions.

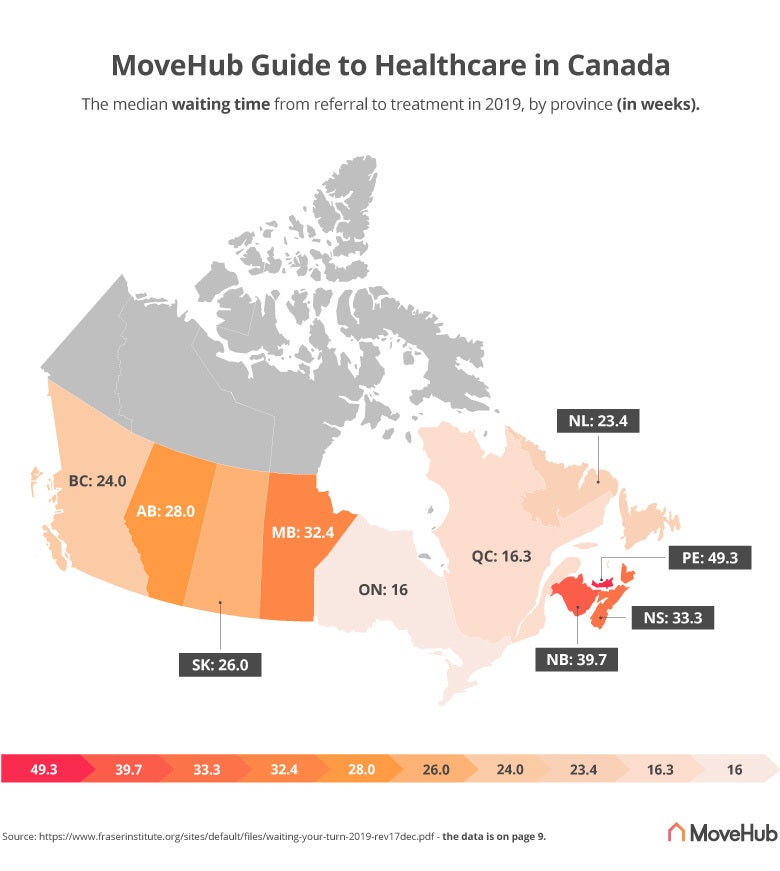

Premiums refer to the monthly or annual fees youpay tohave insurance Thanks to Canadas Income Tax Act ITA deductibility of insurance premiums is a complicated maze of specific rules for specific scenarios. Keep track of the number of kilometres driven during the tax year for your trips relating to moving expenses and northern residents deductions or the 12-month period you choose for medical expenses. In fact in Ontario you can claim a wide range of medical expenses.

Its important to note however that only travel medical insurance is eligible not trip cancellation or interruption insurance. Whether or not your insurance premiums are tax deductible depends on your own or your companys specific tax situation. You must have included in your income in the same year you have the travel expenses the taxable travel benefits that you received from your employment in a prescribed zone.

Her health insurance premium increases to 10000 for the year. If you have travel expenses to get medical services and you also qualify for northern residents deductions line 25500 of your return you may be able to choose how to claim your expenses. Looking for an Income Tax Letter.

You can claim a deduction for medical travel if you have an amount in box 33 of your T4 slip or box 116 of your T4A slip showing any taxable travel benefits you received in the year. And if you are one of our more than 80000 subscribers to Medoc Travel Insurance a part of these premiums may also be eligible to be claimed as medical expenses on line 330 or line 331 of Schedule 1 of your Federal Tax return. Thankfully depending upon how far you have to go for your care the government of Canada may allow you to claim medical expense travel credits.

That confirmation document also acts as your income tax receipt. Claiming your health insurance as a deduction will help to offset the costs of your monthly premium. This tax credit can also be claimed for your spouse common-law partner and children under 18 years of age.

The letter will be issued in the name of the policyholder. Complete the form below to submit your request. Personal health insurance premiums are eligible tax deduction expenses in Ontario Many people dont realize that health insurance premiums are tax-deductible.

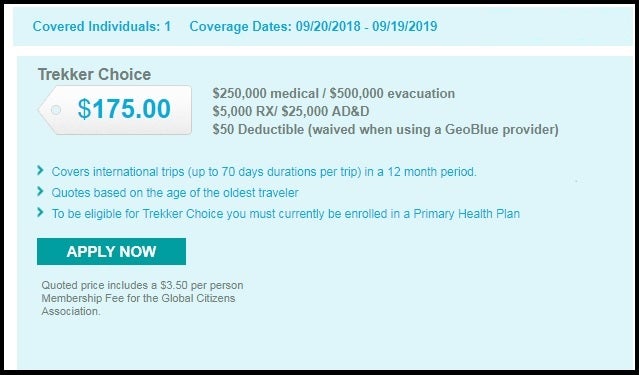

You may not deduct premiums for trip cancellation or other types of travel. Many people may be surprised to learn that travel medical insurance is tax deductible as a medical expense. If you buy a comprehensive travel insurance policy you may only deduct the portion of the policys premium related to travel medical insurance.

Fortunately Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax Credit on your income tax return. As a rule premiums that are paid to private health services plans including medical dental and hospitalization plans are considered to be eligible medical expenses by the Canada Revenue Agency. Whether you are traveling for medical procedures business purposes or just entertainment you may write off the cost of your travel medical insurance premiums.

If a medical practitioner certifies in writing that you were not able to travel alone to get medical services you can also claim the transportation and travel expenses of an attendant. The eligibility for a credit medical expenses are not available as a deduction are contained in s1182 2 q as you mentioned. Please note that if your policy covers you and your spouse you will receive one tax letter for the total premium paid for the year minus any refunds.

The following CRA document should help. Costs of the following devices Income Tax Act s. Travel Medical Insurance premium costs are eligible for the CRA Medical Expense Tax Credit along with other eligible uninsured medical expenses you incur while you are travelling outside Canada.

The medical services had to be for you or a member of your household and must not have been available where you lived. One of the drawbacks of living outside a major city center can be that if you need medical care you may need to travel a long way to get it. Premiums paid to private health plans can be deducted from your business income but you must be the sole proprietor of your business and it must be your primary source of income.

Make sure however that the plan meets the definition of a PHSP outlined in the document and that if. She changes to family coverage only to add her 26-year-old nondependent child to the plan. Premiums paid for private health insurance plans hospitalization medical and dental are often eligible for deduction by the Canada Revenue Agency but does that also apply to the self-employed.

Many of the expenses that you may incur to travel for medical treatment or expenses that you incur on behalf of. Travel expenses outside of Canada when a person is required to travel 80 km or more one way from their home to get medical services outside of Canada which are eligible medical expenses - the expenses include transportation travel accommodations meals and parking.

Family Tax Deductions What Can I Claim 2021 Turbotax Canada Tips

Family Tax Deductions What Can I Claim 2021 Turbotax Canada Tips

What Medical Expenses Are Tax Deductible The Turbotax Blog

What Medical Expenses Are Tax Deductible The Turbotax Blog

What Are Some Self Employed Tax Deductions In Canada

What Are Some Self Employed Tax Deductions In Canada

Are My Travel Insurance Premiums Tax Deductible

Are My Travel Insurance Premiums Tax Deductible

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Trip Cancellation Insurance Forbes Advisor

Trip Cancellation Insurance Forbes Advisor

How State Regulations Impact What Travel Insurance Can Be Purchased

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Displaying Canadian Tax Checklist Jpeg Business Tax Deductions Small Business Tax Deductions Tax Prep Checklist

Displaying Canadian Tax Checklist Jpeg Business Tax Deductions Small Business Tax Deductions Tax Prep Checklist

Travel Health Insurance Plans Health For California

Travel Health Insurance Plans Health For California

Complete Guide To Buying The Best Travel Insurance 2021

Complete Guide To Buying The Best Travel Insurance 2021

Healthcare For Expats In Canada Do You Need Health Insurance

Healthcare For Expats In Canada Do You Need Health Insurance

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Are My Travel Insurance Premiums Tax Deductible

Are My Travel Insurance Premiums Tax Deductible

Claiming Your Dependant S Medical Expenses H R Block Canada

Claiming Your Dependant S Medical Expenses H R Block Canada

Does Medicare Or Medicaid Cover Me Outside The Usa Wheelchairtravel Org

Does Medicare Or Medicaid Cover Me Outside The Usa Wheelchairtravel Org

Most Travel Insurance Plans Won T Help With Coronavirus

Most Travel Insurance Plans Won T Help With Coronavirus

How Long Can A Canadian Snowbird Stay Out Of The Country Msh International Travel Blog

How Long Can A Canadian Snowbird Stay Out Of The Country Msh International Travel Blog

Post a Comment for "Travel Medical Insurance Tax Deductible Canada"