Does Workers Comp Pay For Mileage In Pa

Pennsylvania does not allow amounts of business expenses over and above the amount reimbursed by an employer if the employer provides a fixed-mileage allowance daily weekly monthly or yearly reimbursement unless the reimbursement is included in compensation W-2 wages. If work-related medical treatment can be provided locally in any manner you cannot receive mileage reimbursement if you choose to travel somewhere thats not local to receive your care.

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

Other states such as Alabama set their own mileage reimbursement rates which can typically be found on the states workers compensation agency website.

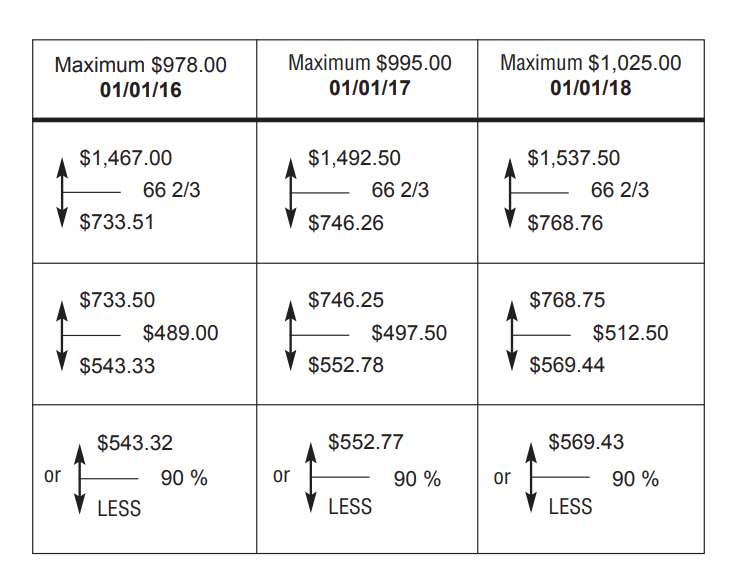

Does workers comp pay for mileage in pa. Mileage reimbursement and wage increases subsequent to the date of disability are not included in. Workers compensation rates may still vary for the same class codes in Pennsylvania because insurance companies can apply policy credits and debits up to 25 to adjust their filed rates. Under the Pennsylvania Workers Compensation Act your average weekly wage is calculated by using the gross wages at the time-of-injury employer without payroll deductions that an employee earned for the 52 weeks preceding the work injury.

For tradesmen commuting costs also include mileage for any job 35 miles or fewer from the closer of the union hall or personal residence to the jobsite. As noted by the Pennsylvania Commonwealth Court in the 2013 case of Mansfield Bros. For those employees who suffer financial hardship following a work-related injury additional expenses required to travel to medical appointments can prove extremely.

PENNSYLVANIA WORKERS COMPENSATION RATES IN 2019. I have found that most employers do pay for mileage expenses even if they are not bound by law to do so. If your salary is high somewhere between 81076 and 162150 per week then you will receive two-thirds of that for your workers compensation benefits.

Accounted for your allowable expenses to your employer and your employer reimbursed you in the exact amount of your expenses. A work injury is any injury medical condition or disease that is caused by a persons job according to Section 301c1 of the Pennsylvania Workers Compensation Act 77 PS. They utilize their own rating system and oversee workers comp rates in Pennsylvania.

It is a narrow application of the law. Reimbursable Travel Expenses According to State Board of Workers Compensation. These are the expenses that are considered payroll You do have to pay workers comp premium on.

A Pennsylvania workers compensation attorney can make clear exactly how workers compensation benefits are structured and adjusted according to the employees wages. The Court has since narrowed the travel reimbursement rule to oftentimes requiring that am injured worker travel within 100 miles one way for medical treatment in order to be reimbursed. Reimbursable travel expenses fall into a few distinct categories.

Some employers pay a fixed daily or monthly rate such as in cases of employees traveling to multiple worksites on a regular basis. Workers Compensation Appeal Board motor vehicle accidents that occur to-and-from work generally arent deemed to occur in the course of employment. Workers who are injured on the job can receive mileage reimbursement for the cost of traveling between their home and any necessary doctors appointments or physical therapy appointments.

But the rules vary from state to state. By Sachi Barreiro Attorney. 17th St Philadelphia PA 19103-4007 Phone.

The amount you pay to provide benefits toward a qualified Section 125 Cafeteria Plan is not considered payroll. Travel to a pharmacy to pick up. In 1915 the Pennsylvania Legislature enacted the Pennsylvania Workmens Workers Compensation Act act.

You can usually get reimbursed for mileage and other costs of getting to doctors appointments and other medical treatment for your work-related injury or illness. Below are answers to some of the most common questions about Pennsylvania workers compensation law. The rate for 2020 is 577 cents per mile.

The mileage reimbursement rate is intended. In some instances you can get mileage reimbursement if that care is not available nearby. Please note that the Bureau of Workers Compensation does not issue certificates of non-insurance.

The amount your employees deduct from their own paycheck to contribute to the Cafeteria Plan is also not going to be considered payroll. Workers comp will pay 54050 each week if your pre-injury earnings were between 60055 to 81075 a week in 2020. What is a Work Injury.

It is not a hard fast rule but is generally applicable. To obtain a certificate of non-insurance contact the Pennsylvania Compensation Rating Bureau United Plaza Building Suite 1500 30 S. What that means is the worker isnt considered to be furthering the business or affairs of the.

The state does allow private insurance companies to compete on rates. Most employers pay their employees at a rate close to that set by the IRS. The statute charges the Department of Labor Industry department and the Bureau of Workers Compensation bureau with carrying out the administrative and appeal obligations defined in the act and specifies compensation for employees who are injured as a result of employment without.

Can I get reimbursed for travel expenses in my workers comp case.

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

How Your Average Weekly Wage Is Calculated For Pa Workers Comp

How Your Average Weekly Wage Is Calculated For Pa Workers Comp

In Pennsylvania Do I Get Reimbursed For Mileage For Doctors Visits Under Workers Compensation

In Pennsylvania Do I Get Reimbursed For Mileage For Doctors Visits Under Workers Compensation

Http Www Dli Pa Gov Documents Regulations Wc Wcact Pdf

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

Workers Compensation Benefits In Pa Calhoon And Kaminsky P C

Life Insurance In Phoenixville And Limerick Pa Group Insurance Commercial Insurance Life Insurance

Life Insurance In Phoenixville And Limerick Pa Group Insurance Commercial Insurance Life Insurance

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Average Workers Comp Settlement Amounts How Much Is My Case Worth

In Pennsylvania Do I Get Reimbursed For Mileage For Doctors Visits Under Workers Compensation

In Pennsylvania Do I Get Reimbursed For Mileage For Doctors Visits Under Workers Compensation

Nj Workers Compensation Lawyer Elizabeth Workers Comp Attorney Personal Injury Attorney Worker Safety Injury Attorney

Nj Workers Compensation Lawyer Elizabeth Workers Comp Attorney Personal Injury Attorney Worker Safety Injury Attorney

What Does Supersedeas Mean In Pennsylvania Workers Comp

What Does Supersedeas Mean In Pennsylvania Workers Comp

Https Www Travelers Com Iw Documents Claim Manage Claim Workers Compensation Pa Ce 10206wcbenefitoverview Pa Pdf

Insurance In Skippack And Royersford Pa Group Insurance Workers Comp Insurance Home Worker

Insurance In Skippack And Royersford Pa Group Insurance Workers Comp Insurance Home Worker

Permanent Restrictions For Workers Comp In Pennsylvania

Permanent Restrictions For Workers Comp In Pennsylvania

How Much Are Your Balls Worth A State By State Guide Workmans Comp Infographic Tomorrow News

How Much Are Your Balls Worth A State By State Guide Workmans Comp Infographic Tomorrow News

Is Light Duty Really Light Duty Duties Light Physics

Is Light Duty Really Light Duty Duties Light Physics

Permanent Restrictions For Workers Comp In Pennsylvania

Permanent Restrictions For Workers Comp In Pennsylvania

A Pennsylvania Employee Recently Settled Her Workers Compensation Claim With The Southeastern Pennsylvania Transportation Auth Railway Station Passenger Photo

A Pennsylvania Employee Recently Settled Her Workers Compensation Claim With The Southeastern Pennsylvania Transportation Auth Railway Station Passenger Photo

7 Deadly Sins That Can Destroy Your Pennsylvania Workers Comp Case

7 Deadly Sins That Can Destroy Your Pennsylvania Workers Comp Case

Https Www Wwdlaw Com Wp Content Uploads 2019 09 Wwd Pa Workers Comp Booklet 2017 Final 5 Pdf

Post a Comment for "Does Workers Comp Pay For Mileage In Pa"