How Much Does Workers Comp Pay For Mileage In California

A 2018 study indicated that the average rates in CA were almost 188 higher than the study medium. If the insurer doesnt pay within this timeframe it can be subject to a late penalty.

How Does Workers Comp Pay For Lost Wages In Ca

How Does Workers Comp Pay For Lost Wages In Ca

For example if the injured worker incurred a medical mileage expense between July 1 2006 to December 31 2006 the rate is 445mile.

How much does workers comp pay for mileage in california. In some situations employers may have more than one risk classification that applies to any given worker. Topics covered in this section Death benefits Mileage. Medical mileage expense form.

Medical mileage compensation in California dropped in 2016 from 0575 to 054 the lowest it had been since 2011. If you need a medical mileage expense form for a year not listed here please contact the Information and Assistance Unit at your closest district office of the Workers Compensation Appeals Board. 51 rows Workers compensation benefits.

The workers compensation insurer has 15 days to provide reimbursement after youve submitted documentation of mileage meals and lodging. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. Unpaid travel time can exceed over 100000 in lost wages interest and penalties.

The workers comp agencies in many states provide standard mileage reimbursement forms that can be used for this purpose. The basic rule in California workers compensation claims has long been that injured workers are entitled to reimbursement for mileage to attend medical evaluations and treatment appointments. The mileage rate has changed year by year in California ranging from a low of 0445 in 2006 to a high of 0575 in 2015.

For 2020 the weekly maximum is 129943 and the minimum is 19491. This year workers can expect yet another drop that began on January 1 2017. Formula to Determine Premium.

A comprehensive guide to travel time pay rules in Californiawhen employees are entitled to be paid for travel time and how to recover those lost wages. 500 X 771 3855 per week. Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile.

The cost per mile is designated by state law. 58 cents per mile for business miles driven up 35 cents from 2018 20 cents per mile driven for medical or moving purposes up 2 cents from 2018. The 2019 IRS mileage rate is as follows.

California has been the most expensive state for workers compensation insurance coverage. For mileage incurred in calendar year 2021 the mileage reimbursement rate is 056 per mile. What Is the Law Governing Mileage Reimbursement in California.

Find out how much of your travel time should be paid and how you can recover it. If youre able to return to work but youre earning less than usualfor example because the work is part time or light duty you can receive temporary partial disability benefits. How Do I Get Reimbursed.

And 14 cents per mile driven in service of charitable organizations. California was ranked 13th in 2016 but rates have steadily increased since then. How much workers comp pays for an injured employee is based on a simple formula or workers comp calculator using their average weekly wage on the date of the injury.

You can click on the dates in the above chart and link to a Medical Mileage Expense Form for that specific period of time which you can print and use to request reimbursement. To seek reimbursement you should keep a mileage log noting the miles that you drive during each trip to your doctor therapist or other treatment approved through workers comp. For example a staff members job may have both a high-risk and a low-risk classification.

Other states set their own mileage rates. As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile. Learn about the workmens compensation calculation and how workers comp is calculated from The Hartford.

However if an employers policy sets a higher per-mile reimbursement rate they may pay the higher amount.

Minutes Of Hearing Order Order And Decision On Request For Continuance California Decisions Order

Minutes Of Hearing Order Order And Decision On Request For Continuance California Decisions Order

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Stipulation And Order To Pay Lien Claimant California Planner Printables Free California State

Stipulation And Order To Pay Lien Claimant California Planner Printables Free California State

Mileage Log Book Template In 2021 Book Template Templates Bottle Label Template

Mileage Log Book Template In 2021 Book Template Templates Bottle Label Template

Ca Medical Mileage Expense Forms Workers Comp Mileage Reimbursement

Ca Medical Mileage Expense Forms Workers Comp Mileage Reimbursement

This Is A California Form That Can Be Used For Eams Forms Within Workers Comp Download This Form For Free Now California Wor California Application Answers

This Is A California Form That Can Be Used For Eams Forms Within Workers Comp Download This Form For Free Now California Wor California Application Answers

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Exhibit And Witness Cover Sheet California Cover How To Plan

Exhibit And Witness Cover Sheet California Cover How To Plan

Special Notice Of Lawsuit California In Law Suite Special

Special Notice Of Lawsuit California In Law Suite Special

This Is A California Form That Can Be Used For General Within Workers Comp Download This Form For Free Now California Workerscomp G Worker Form California

This Is A California Form That Can Be Used For General Within Workers Comp Download This Form For Free Now California Workerscomp G Worker Form California

Form A 3b Application For A Permanent Certificate Of Consent To Self Insure California Form This Or That Questions

Form A 3b Application For A Permanent Certificate Of Consent To Self Insure California Form This Or That Questions

Notice Of Hearing California California State Hearing

Notice Of Hearing California California State Hearing

Application For Subsequent Injuries Fund Benefits Application California Fund

Application For Subsequent Injuries Fund Benefits Application California Fund

California Workers Compensation Law Brief Description

California Workers Compensation Law Brief Description

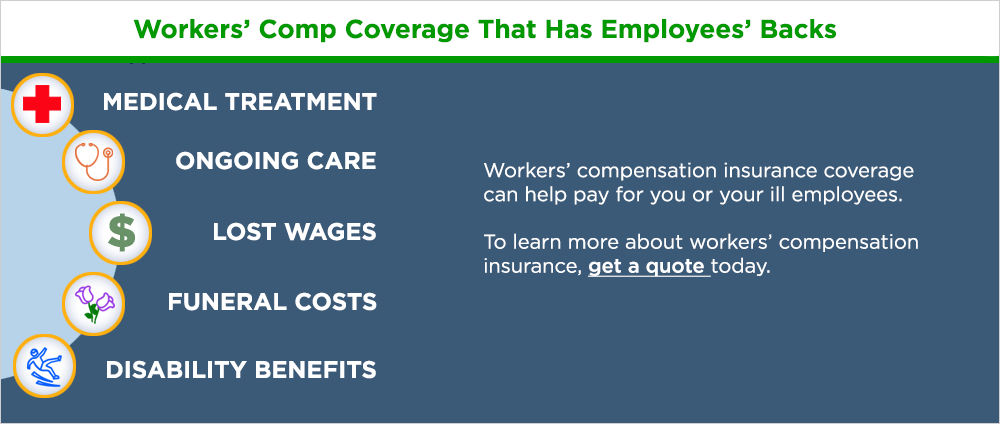

What Does Worker S Compensation Cover The Hartford

What Does Worker S Compensation Cover The Hartford

10 Reasons You Need A Workers Comp Lawyer In California

10 Reasons You Need A Workers Comp Lawyer In California

This Is A California Form That Can Be Used For Eams Forms Within Workers Comp Download This Form For Free Now California Worke California Words Declaration

This Is A California Form That Can Be Used For Eams Forms Within Workers Comp Download This Form For Free Now California Worke California Words Declaration

Notice Of Offer Of Modified Or Alternative Work Between 1 1 04 And 12 31 12 California Alternative California State

Notice Of Offer Of Modified Or Alternative Work Between 1 1 04 And 12 31 12 California Alternative California State

Determination Of Employment Work Status For Purposes Of State Of California Employment Taxes Work Status California California State

Determination Of Employment Work Status For Purposes Of State Of California Employment Taxes Work Status California California State

Post a Comment for "How Much Does Workers Comp Pay For Mileage In California"