How To Calculate Workers Comp Mileage

All these line items affect how much you are paying for workers compensation directly impacting the class code or base rates the carrier is using. C a b Where C Compensation Due a Distance Driven b Compensation Per Mile.

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Deduction Business Tax

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Deduction Business Tax

Workers Compensation Health Care Payment System.

How to calculate workers comp mileage. Workers Compensation Health Care Payment System. If you drove 1000 miles and get reimbursed50 cents per mile your reimbursement would be 500 1000 X50 500. What makes it even more confusing is that many of these rates including the base rates themselves are completely up.

How much workers comp pays for an injured employee is based on a simple formula or workers comp calculator using their average weekly wage on the date of the injury. The mileage rate for reimbursement to injured workers for travel by automobile on or after January 1 2021 is 56 cents per mile in accordance with the Board resolution adopted on February 20 1990. This new system includes.

You then multiply that number by the premium rate for the class code to find the total cost of workers compensation insurance for that employee. Multiply the number of business miles driven by the reimbursement rate. Fill out the TransportationTravel Expense Form VWCC Mileage Expense-Form and prepare it to be sent to the workers compensation insurance company.

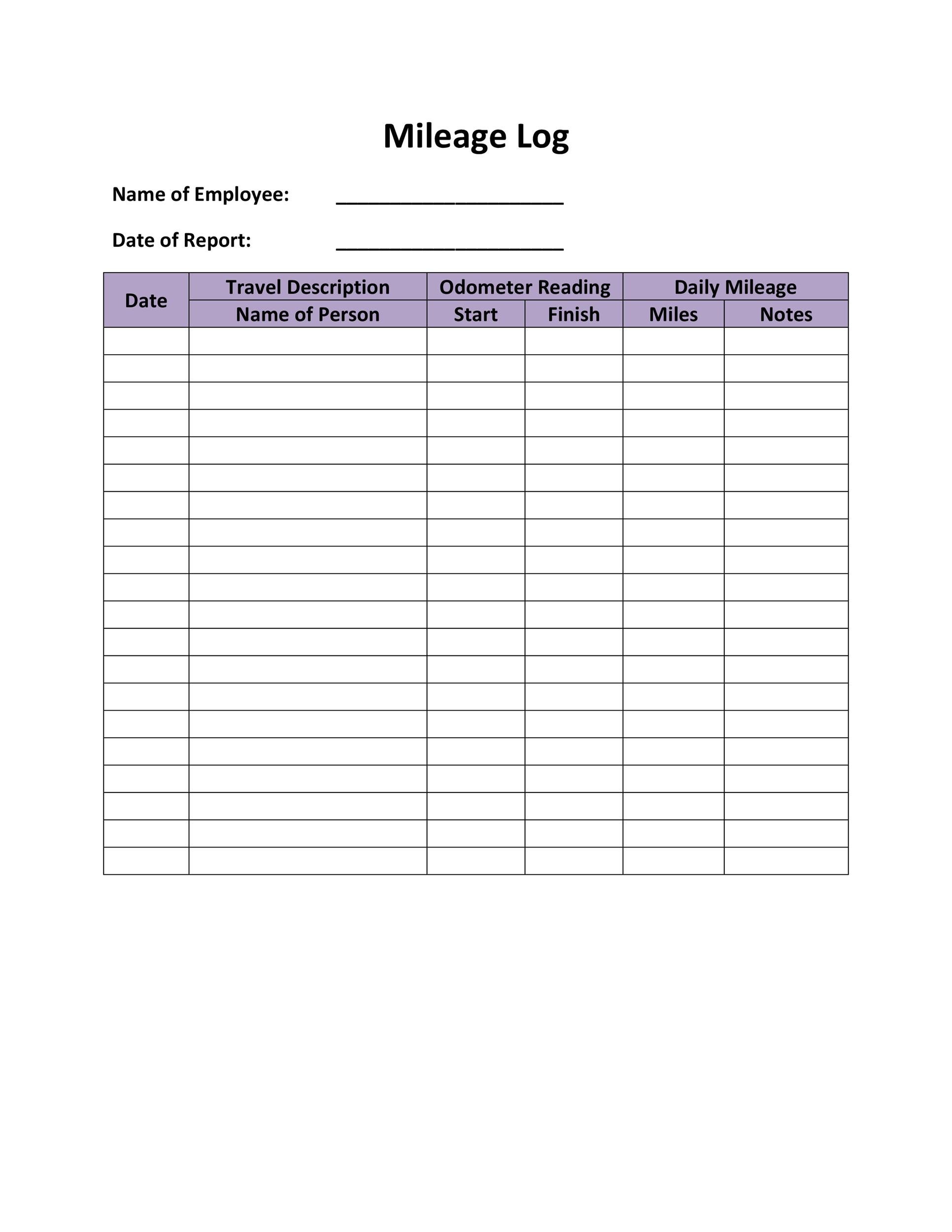

Something like a mileage-tracking app will help you keep track of your drives. Fill in the chart with the dates you traveled the addresses you traveled from and to and total miles traveled. Additionally the mileage shall be calculated from the injured workers home or wherever they are living and the facility.

For example if you received 440 a week as a total temporary benefit the most you could receive if you collected partial benefits would be 330 a week. Mileage and meal reimbursement rates. Any time an employee is examined by a doctor for their California work injury he or she is entitled to be reimbursed for the miles to and from the examination.

The business owner Artie should find the difference between the odometer readings and multiply it by the standard mileage reimbursement rate. To calculate your total mileage reimbursement multiply the mileage reimbursement rate for that year by the total number of miles traveledFor example if your doctors office is five 5 miles from your home and you had a doctors appointment on January 1 2018 multiply the mileage reimbursement rate by the total number of miles traveled to and from the appointment. Under the Pennsylvania Workers Compensation Act your average weekly wage is calculated by using the gross wages at the time-of-injury employer without payroll deductions that an employee earned for the 52 weeks preceding the.

The statutory caps are also noted. What is mileage reimbursement. In those instances where injured workers are entitled to reimbursement for travel expenses insurers will reimburse injured workers for travel in.

These charts provide a history of the maximum annual benefit adjustments. Learn about the workmens compensation calculation and how workers comp is calculated from The Hartford. Your weekly workers compensation is based upon your average weekly wage at the time of the work injury.

Every state has a different way of handling workers comp so we will highlight some of the specific ways that California is unique. Rule 203 e states that the mileage reimbursement shall be paid at 040 per mile. Rate information statewide average weekly wage SAWW Annual benefit adjustments.

Be sure to fill out your name address date of your work injury. Reasonable expenses of transportation includes mileage parking and bridge tolls. The maximum weekly benefit is 75 of your weekly total temporary benefits.

If you need a medical mileage expense form for a year not listed here please contact the Information and Assistance Unit at your closest district office of the Workers Compensation Appeals Board. Temporary total benefits are 60 of your gross average weekly wage. Choose the file that is applicable for the date of injury.

An injured worker is entitled to reimbursement of reasonable expenses of transportation if they have to travel to get treatment for a work injury. Mileage for reasonable travel to and from doctors hospitals therapy or pharmacy is payable as follows. An easy way to calculate this mileage is to use Google Maps or a similar type of service.

1 Medical mileage reimbursement comprises transportation costs to and from all types of medical treatment including physical therapy chiropractic treatment and prescriptions. Once you have the estimated annual payroll for the employee divide that number by 100. In accordance with 19 Del.

2322 and effective 52308 the Governor appointed Health Care Advisory Panel HCAP established a Workers Compensation Health Care Payment System HCPS for Delaware. Medical mileage expense form. Its relatively simple to calculate mileage reimbursement.

This is the allowable deduction while calculating income tax for businesses self-employed individuals or other taxpayers in United. S1710804 workers compensation 90000 s1710805 disability 21000 s1710806 hosp med 1400000 sub total 2761000 s1720402 claimant mileage medical 1138000 s1720406 claimant indemnity 28300000 s1720431 attorney fees claimant 1100000 s1720433 claimant medical 21700000 sub total 52238000. Whether you or someone close to you is experiencing an injury or illness its important to understand how to calculate workers compensation benefits in the state of California.

Compare your calculations against workers comp insurers.

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Workers Compensation Reimbursement For Mileage Rechtman Spevak

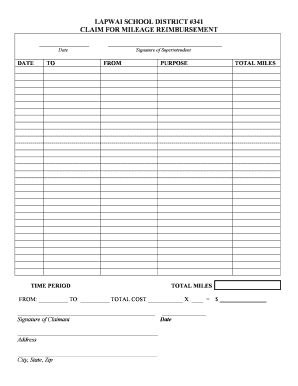

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

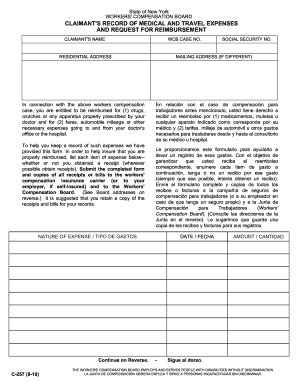

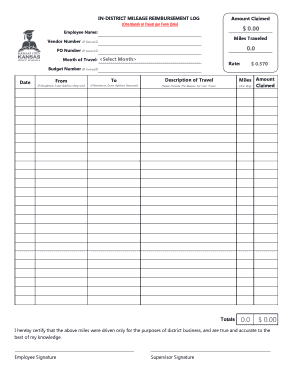

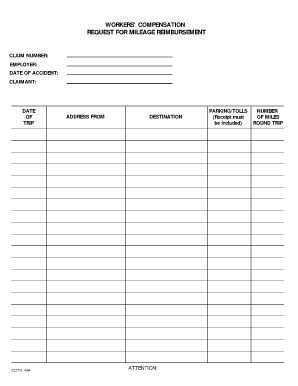

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Ca Medical Mileage Expense Forms Workers Comp Mileage Reimbursement

Ca Medical Mileage Expense Forms Workers Comp Mileage Reimbursement

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Mileage Tracker Pdf Planner Automobile Mileage Log Or Etsy In 2021 Mileage Tracker Mileage Tracker Printable Planner Pages

Mileage Tracker Pdf Planner Automobile Mileage Log Or Etsy In 2021 Mileage Tracker Mileage Tracker Printable Planner Pages

Mileage Tracking And Log Mileage Tracker Mileage Tracker App Tracking App

Mileage Tracking And Log Mileage Tracker Mileage Tracker App Tracking App

Interactive Inspiration 134 Visualoop Worker Compensation Money Chart

Interactive Inspiration 134 Visualoop Worker Compensation Money Chart

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

All About Mileage June 1 2018 Levesque Associates Inc Small Business Owner Mileage Business Owner

All About Mileage June 1 2018 Levesque Associates Inc Small Business Owner Mileage Business Owner

Mileage Verification Form Fill Out And Sign Printable Pdf Template Signnow

Mileage Verification Form Fill Out And Sign Printable Pdf Template Signnow

Christopher J Smith P A Resources For Injured Workers Florida Workers Compensation

Christopher J Smith P A Resources For Injured Workers Florida Workers Compensation

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Mileage Log Templates 2 Free Printable Word Excel Formats Templates Mileage Free Printables

Mileage Log Templates 2 Free Printable Word Excel Formats Templates Mileage Free Printables

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

18 Printable Workers Comp Mileage Reimbursement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Workers Comp Q A What If My On The Job Injury Was My Fault Injury Lawyer Injury My Fault

Workers Comp Q A What If My On The Job Injury Was My Fault Injury Lawyer Injury My Fault

Do You Know Your Cost Per Mile Check Out Ooida S Free Cost Per Mile Spreadsheet To Help You Calculate Ju Trucking Business Workers Compensation Insurance Cost

Do You Know Your Cost Per Mile Check Out Ooida S Free Cost Per Mile Spreadsheet To Help You Calculate Ju Trucking Business Workers Compensation Insurance Cost

Post a Comment for "How To Calculate Workers Comp Mileage"