Travel Expenses Paid By Employer

Make sure your employer completes your pay stub correctly to reimburse your travel expenses. If employees mix business and personal travel you need to sort out the part that is business-related and pay only these expenses.

Https Www Hrblock Com Tax Center Wp Content Uploads 2016 03 Hr Block Tti Business Travel Deductions Pdf

That is you can include these costs on your business tax return if you can show they are ordinary and necessary business expenses.

Travel expenses paid by employer. The employer must also provide or pay the reasonable costs for lodging where lodging is necessary. Most employers pay or reimburse their employees expenses when traveling for business. It may depend on the job position you hold.

It may depend on the industry youre working in. If you pay for lodging for employees under any of the arrangements above this expense is considered to be deductible as a business expense. Time spent in home-to-work travel by an employee in an employer-provided vehicle or in activities performed by an employee that are incidental to the use of the vehicle for commuting generally is not hours worked and therefore does not have to be paid.

Payments to employees belong on form W-2 not Form 1099. However the tax rules become more complex when the travel is of a longer duration. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job.

If a travel companion expenses are paid and the companion is not attending the meeting for a valid business reason the employee is subject to a taxable fringe benefit. If not provided by the employer the amount an employer must pay for transportation and where necessary lodging must be no less than and is not required to be more than the most economical and reasonable costs. You cant deduct expenses that are lavish or extravagant or that are for personal purposes.

In order to deduct the travel. Time spent traveling during normal work hours is considered compensable work time. 511 Business Travel Expenses.

Generally expenses for transportation meals lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. It does not directly reduce the amount of taxes you owe. As an employer paying your employees travel costs you have certain tax National Insurance and reporting obligations.

This includes costs for. Expenses reimbursed under an accountable plan are also deductible as business expenses by the employer subject to any federal income tax limitations pertaining to a particular expense ie meals gifts listed property. However the tax rules become more complex when the travel is of a longer duration.

To prevent you from getting taxed on the reimbursement you will have to report the expenses that were reimbursed. Do I have to pay taxes on travel reimbursement paid to me by my employer. The Department of Labor doesnt require reimbursement for travel expenses but it makes sense to pay employees if you require them to travel.

Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer. Yes this was a reimbursement but the employer was justified in sending you a 1099-MISC. Your business can deduct employee travel expenses as a business expense.

Deducting the business expenses on your tax return is not the same as getting a tax credit. However its a different story if the trip is not entirely for business purposes. It may depend on the work equipment you need.

This provision applies only if the travel is within the normal. Lodging Expenses and Taxes Tax Deductible for the Employer. Most employers pay or reimburse their employees expenses when traveling for business.

As evident the question of who covers the expenses of remote work the employer or the employee may depend on a lot of factors. Not only that but all travel expenses are deductible in that case. If the employee doesnt incur any travel expenses the employee will receive the same total amount of hourly compensation but.

Client site visits and hotel stays for overnight business trips count as unreimbursed employee expenses when your employer doesnt offer mileage reimbursement a per. Generally expenses for transportation meals loding and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. Otherwise you might improperly pay more taxes.

When an employee incurs travel expenses the employer will treat a portion of the hourly compensation paid to the employee as a nontaxable per diem allowance for travel expenses and treat the remainder as wages. Finally if a payment falls outside your accountable plan that payment is considered a taxable benefit. If the taxpayer travels outside the United States expenses for travel can be deducted if the trip is entirely for business purposes.

The Impact Of A Bad Expense Reporting Process On Your Business Sutisoft Blog Expense Management Business Performance Profitable Business

The Impact Of A Bad Expense Reporting Process On Your Business Sutisoft Blog Expense Management Business Performance Profitable Business

Free Printable Travel Expense Report Pdf Template Expense Sheet Expenses Printable Expensive

Free Printable Travel Expense Report Pdf Template Expense Sheet Expenses Printable Expensive

Travel And Expense Policy And Procedure How To Write A Travel And Expense Policy And Procedure Download This Travel Traveling By Yourself Policies Templates

Travel And Expense Policy And Procedure How To Write A Travel And Expense Policy And Procedure Download This Travel Traveling By Yourself Policies Templates

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

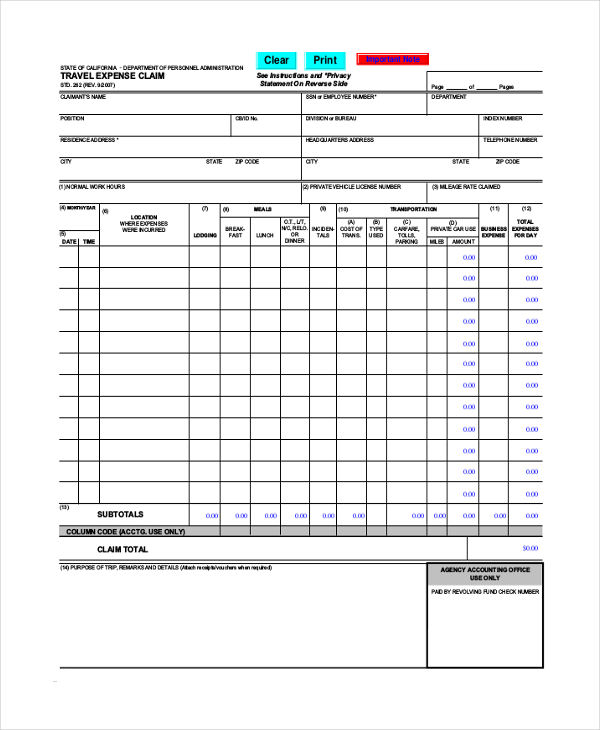

Free 11 Sample Travel Claim Forms In Pdf Ms Word Excel

Free 11 Sample Travel Claim Forms In Pdf Ms Word Excel

Sample Expense Sheet Template Pdf Word Excel Apple Pages Google Docs Google Sheets Apple Numbers Expense Sheet Sheet Sign Up Sheets

Sample Expense Sheet Template Pdf Word Excel Apple Pages Google Docs Google Sheets Apple Numbers Expense Sheet Sheet Sign Up Sheets

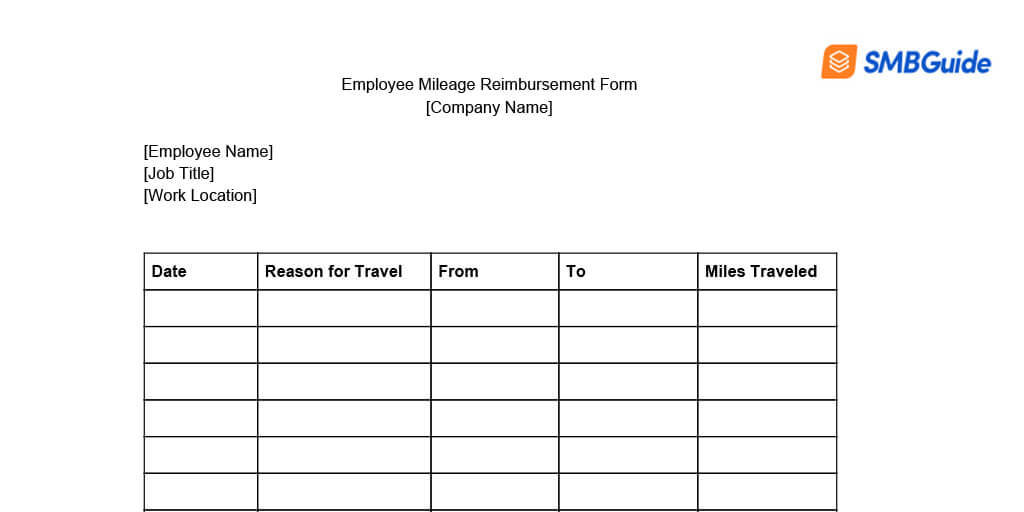

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

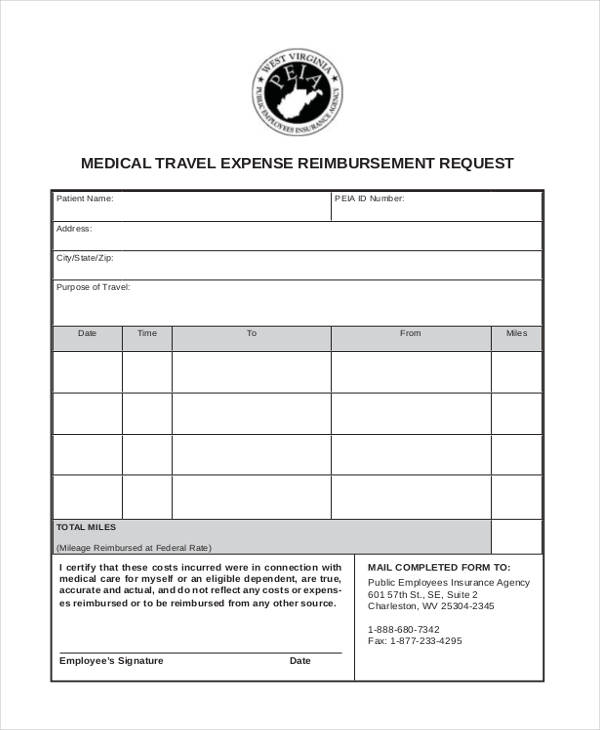

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Quality Travel Expense Invoice Template In 2021 Report Template Invoice Template Templates

Quality Travel Expense Invoice Template In 2021 Report Template Invoice Template Templates

Travel Reimbursement Form Template Luxury Mileage Reimbursement Form In Word And Pdf Formats Templates Elementary Lesson Plan Template How To Memorize Things

Travel Reimbursement Form Template Luxury Mileage Reimbursement Form In Word And Pdf Formats Templates Elementary Lesson Plan Template How To Memorize Things

What Is Per Diem The Per Diem Allowance Is Paid By The Employer To Its Employees For Lodging Meals And Incidental Expenses Incurr Per Diem Diem Tax Exemption

What Is Per Diem The Per Diem Allowance Is Paid By The Employer To Its Employees For Lodging Meals And Incidental Expenses Incurr Per Diem Diem Tax Exemption

Https Www Agc Org Sites Default Files Agc 20guide 20to 20employee 20travel 20expense 20reimbursement Pdf

Free 13 Travel Reimbursement Forms In Pdf Ms Word Excel

Free 13 Travel Reimbursement Forms In Pdf Ms Word Excel

Business Travel Expenses 9 Hacks For Cost Control Insperity Business Travel Travel Business

Business Travel Expenses 9 Hacks For Cost Control Insperity Business Travel Travel Business

Employee Payroll Template Alludes To The Compensation Paid To The Workers For Services They Give Amid A Specific Time Fram Payroll Template Payroll How To Plan

Employee Payroll Template Alludes To The Compensation Paid To The Workers For Services They Give Amid A Specific Time Fram Payroll Template Payroll How To Plan

How To Properly Record Travel Expenses For Deduction Affordable Bookkeeping Payroll Deduction Credit Card Statement Traveling By Yourself

How To Properly Record Travel Expenses For Deduction Affordable Bookkeeping Payroll Deduction Credit Card Statement Traveling By Yourself

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Templates

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Templates

Travel Advance Request Form404 Templates Form Request

Travel Advance Request Form404 Templates Form Request

Post a Comment for "Travel Expenses Paid By Employer"