What Does It Take To Become A Public Adjuster

Please include your name in the email as it appears on your drivers license. There are two main certifications for public adjusters.

Public Adjuster 101 What Happens If You Don T Have A Public Adjuster Bulldog Adjusters

Public Adjuster 101 What Happens If You Don T Have A Public Adjuster Bulldog Adjusters

How to Become a Public Adjuster in 6 Steps Step 1.

What does it take to become a public adjuster. You also need to be expeditious. Have successfully completed the written Public Adjuster examination no pre-licensing education required - Link to Exam Scheduling Instructions Must also request a certificate to take exam prior to exam by emailing agentlicensingidoiingov. A successful public adjuster must be fluent in all areas of the claims process to navigate the claim successfully through the claims process including notice of loss investigation negotiation final settlement andor disposition.

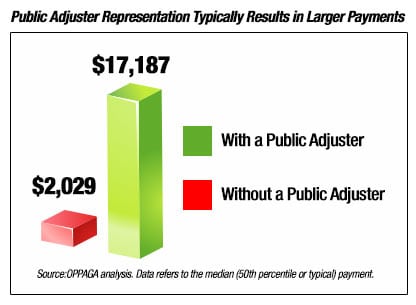

Once you accept the final offer from your insurance company the public adjuster will take a pre-arranged cut of the final payout. If you do not have these you should consider enrolling in GED courses and passing the GED exam. The licensing procedure for public adjusters is different in every state but it will usually require some combination of the following.

Complete Your General Education. In conjunction with the renewal process resident individual public adjusters must complete 24 hours of CE 3 of which must be Ethics every 24 months. Qualifications for Becoming a Public Adjuster Most states require a public adjuster to hold a state public adjuster license.

Public insurance adjusters must be licensed in every individual state they practice in. Submitting an application and application fee to your state insurance commissioner. Proof of financial responsibility.

A high school diploma or a GED is generally the minimal level of education for a public adjuster. The next step for all aspiring public adjusters is. In most cases this is the one and only time the public adjuster gets paid and you do not pay your public adjuster a dime until you receive the final payout from your insurer.

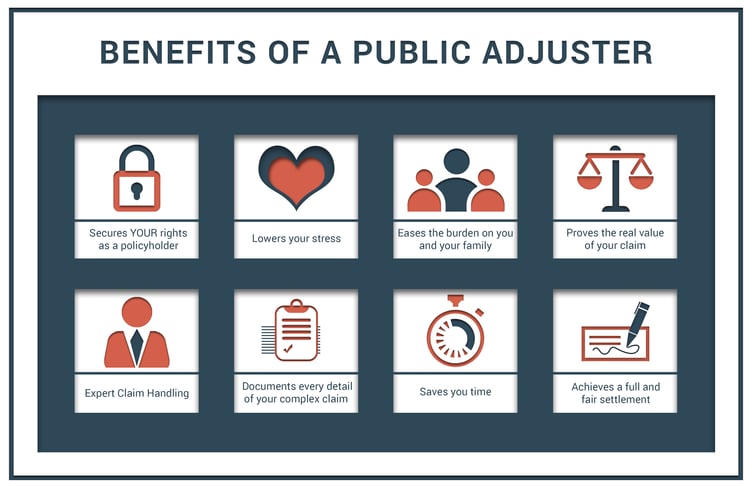

Public adjusters can be members of national or state associations which set standards for the profession. Having damage to your home is stressful and difficult. Adjuster Pre-Exam Education.

Most insurance claims adjuster positions do not require individuals to hold a bachelors degree or higher. Public adjusters are professionals who are required to have a certain amount of knowledge and training. In order to become a claims adjuster you must have a minimum of a high school diploma or GED equivalent.

Completion of an educational program experience in claims adjusting passage of a licensing exam or some combination of the three are typical. Every Georgia public adjuster must receive a license from the Office of the Commissioner of Insurance prior to working within the state. Requirements are found in the public adjuster section of the Insurance Licensing Candidate Handbook.

At least one officer or active partner must have an individual Public Adjuster License. Along with your application you must send. To become a licensed adjuster all requirements must be met in accordance with Section 33-23-6 of the Georgia Insurance Code and 120-2-3-18 of the Georgia Insurance Department Rules and Regulations.

The first thing they should check is whether the public adjuster can legally practice. Look for associations. Your college major will generally depend on the type of.

However many clients and employers want public adjusters with a bachelors degree or some experience in the insurance industry. Public adjusters face varying licensing requirements from state to state. Proof you have a surety bond of 10000 or more.

The Certified Professional Public Insurance Adjuster must have been working in the field for at least five years and pass a series of exams. Preparation for this exam is not something to take lightly as the average pass rate of insurance exams nationwide is around 55 for first-time test-takers and. There are a number of things a policyholder can do to make sure they are hiring a good public adjuster.

The Senior Professional Public Adjusters must have. Since theyre already familiar with the process the necessary steps can be completed quickly. Some states may also direct you to post a surety bond.

Public Adjuster Pros and Cons for Your Insurance Claim. The minimum required education to become a public insurance adjuster is a high.

Texas Public Insurance Adjuster Licensing A Definitive Guide

Texas Public Insurance Adjuster Licensing A Definitive Guide

How To Become A Public Insurance Adjuster

How To Become A Public Insurance Adjuster

How To Become A Public Insurance Adjuster

How To Become A Public Insurance Adjuster

How To Become A Public Adjuster Fresh 2021 Education Salary Guide

How To Become A Public Adjuster Fresh 2021 Education Salary Guide

Insurance Adjuster Classes Major Adjusters Insurance Adjuster Training

Insurance Adjuster Classes Major Adjusters Insurance Adjuster Training

Public Adjusters For Mold Damage Churchill Public Adjusters

Public Adjusters For Mold Damage Churchill Public Adjusters

Should Homeowners Hire A Public Adjuster After A Loss Crown Adjusting

Should Homeowners Hire A Public Adjuster After A Loss Crown Adjusting

How To Become A Public Insurance Adjuster

How To Become A Public Insurance Adjuster

Benefits Of Hiring A Public Adjuster Pfister Adjusting Inc

Texas Public Insurance Adjuster Licensing A Definitive Guide

Texas Public Insurance Adjuster Licensing A Definitive Guide

3 Ways To Become A Public Adjuster Wikihow

3 Ways To Become A Public Adjuster Wikihow

Why You Need The Help Of A Public Adjuster Commercial Insurance Public Online Communication

Why You Need The Help Of A Public Adjuster Commercial Insurance Public Online Communication

Pros And Cons Of Hiring A Public Adjuster The Claim Squad

How To Become A Public Insurance Adjuster

How To Become A Public Insurance Adjuster

Texas Public Insurance Adjuster Licensing A Definitive Guide

Texas Public Insurance Adjuster Licensing A Definitive Guide

How To Become An Insurance Adjuster With A Minimal Financial Investment Theselfemployed Com

How To Become An Insurance Adjuster With A Minimal Financial Investment Theselfemployed Com

How To Get A Florida Public Adjuster License A Definitive Guide Surety Bond Insider

How To Get A Florida Public Adjuster License A Definitive Guide Surety Bond Insider

Understanding Public Adjuster Fees

Understanding Public Adjuster Fees

Post a Comment for "What Does It Take To Become A Public Adjuster"