Is It Worth Purchasing Gap Insurance

How does gap insurance work. Heres an example of a policy with a total annual premium cost of 1500.

Is Buying Car Gap Insurance Worth It Trusted Choice

Is Buying Car Gap Insurance Worth It Trusted Choice

A typical gap insurance premium is calculated based on the collision and comprehensive coverage premiums in a policy and it typically costs about 5 or 6 of that cost.

Is it worth purchasing gap insurance. Gap insurance is one way to avoid this financial problem. For example if you owe 25000 on your loan and your car is only worth 20000 your policys loanlease payoff coverage covers the 5000 gap minus your deductible. Sometimes you need to invest in more coverage than the minimum car insurance requirements.

Gap insurance is a good option for the following types of drivers. Gap insurance protects you from depreciation. Drivers who owe more on their car loan than the car is worth.

If there is any time during which you owe more on your car than it is currently worth gap insurance is definitely worth the money. If you are currently making car loan payments be sure to calculate the loan balance and weigh it against your cars current cash value. When you purchase a brand-new car its value falls by a third as soon as you drive it.

The gap insurance rates quoted at dealerships can be up to 4. When your loan amount is more than your vehicle is worth gap insurance coverage pays the difference. GAP insurance is worth it if youll ever owe more on your loan than what the vehicle is worth.

Its more than worth it to consider purchasing gap insurance from anywhere but a car dealership. Made a small down payment on a new car or none at all. The Insurance Information Institute estimates that new cars lose about 20 percent of their value in the first year of ownership.

When purchasing a new or used car one extra level of protection that you might be offered is GAP insurance. Fortunately gap insurance is pretty cheap. Its protection from the worst possible scenario that could happen.

While it is uncommon you can get GAP insurance for a used vehicle often known as a loanlease payoff program. Dealers will usually charge you between 600 - 900 for GAP coverage however in most cases you can add GAP coverage to your auto policy for around 25-30 per year per vehicle. So if you bought a new or used car from a dealer then this is probably the right type of policy for you.

Most dealers will try and talk you into buying GAP coverage from them if you take out a loan on a car period. And while it might be easy to just brush it off as an unneeded added cost you might want to think twice about buying it depending on how old the car is and what your loan terms are. Return to invoice RTI This pays out the difference between the amount you get from your car insurer and the invoice price you paid for your vehicle.

Having GAP Insurance cover on a new car is like an extra layer of bubble wrap around your finances. There is really no reason to roll the gap policy into your dealership finance agreement since you typically only need to get protection for a few years. Gap insurance may be worth it if you.

There are three main types of policy. Agreed to a loan term longer than 48 months. However it is usually best to avoid buying this insurance from the dealership where you purchased your car.

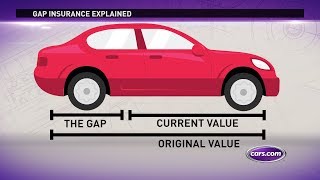

Its an optional coverage you can buy that covers the gap between what you owe and the value of. Depreciation is the difference between what you paid for your car and the amount its now worth. The reason gap insurance exists But before we go into the pros and cons its worth looking at one of the main reasons gap insurance exists and why people buy and it is because cars lose their value depreciate quickly especially if theyre new.

Like all insurance policies you really will think it was worth buying if you need to claim on the policy. The reason for this is that used cars do not depreciate in value as quickly as new cars. If you plan to finance a car purchase or if you are planning to lease a new vehicle you may want to consider purchasing gap insurance.

Gap insurance is only worth it providing you buy a policy which is suitable to your needs. Gap insurance covers the gap between the amount you still owe on your auto loan and your cars actual cash value ACV as determined by your insurance carrier at the time of an auto accident that results in a total loss of usability or if the car is stolen. Gap insurance is a wise choice in any of these circumstances.

You can purchase gap insurance from the car dealership your finance company or an independent insurance agent. Here is why GAP insurance could be worth buying. While GAP insurance is strongly recommended when purchasing brand new cars it is less of a necessity when buying a used car.

GAP insurance is a policy that pays out when a car is written off or stolen and not recovered and pays the difference between the insurance payout and the original purchase price or the outstanding finance settlement whichever is greater.

What Is Gap Insurance Is It Worth It

What Is Gap Insurance Is It Worth It

Is Buying Car Gap Insurance Worth It Trusted Choice

Is Buying Car Gap Insurance Worth It Trusted Choice

Full Coverage Car Insurance Cost Of 2021 Insurance Com

Full Coverage Car Insurance Cost Of 2021 Insurance Com

What Is Gap Insurance Is It Worth It

What Is Gap Insurance Is It Worth It

Do You Need Gap Insurance On A Lease Car Moneyshake

Do You Need Gap Insurance On A Lease Car Moneyshake

Is Gap Insurance Worth It Experian

Is Gap Insurance Worth It Experian

What Is Gap Insurance And What Does It Cover Credit Karma

What Is Gap Insurance And What Does It Cover Credit Karma

Blog Posts Property And Casualty Casualty Insurance Insurance

Blog Posts Property And Casualty Casualty Insurance Insurance

Do You Need Gap Insurance For Your Car Forbes Advisor

Do You Need Gap Insurance For Your Car Forbes Advisor

What Is Gap Insurance Is It Worth It

What Is Gap Insurance Is It Worth It

What Is Gap Insurance For A Car U S News World Report

What Is Gap Insurance For A Car U S News World Report

What To Do With A Totaled Car Without Insurance Autoinsurance Org

What To Do With A Totaled Car Without Insurance Autoinsurance Org

Is Gap Insurance Worth It Nationwide

Is Gap Insurance Worth It Nationwide

What Is Gap Insurance For A Car U S News World Report

What Is Gap Insurance For A Car U S News World Report

Should You Buy Gap Insurance Its One Of The First Questions Youll Have To Answer After Securing An Auto Loan Learn Exactly What Gap In Car Loans Insurance Gap

Should You Buy Gap Insurance Its One Of The First Questions Youll Have To Answer After Securing An Auto Loan Learn Exactly What Gap In Car Loans Insurance Gap

What Is Gap Coverage And Why Might You Want It When You Buy A Car What Is Gap Coverage And Why Might You Want It When You Buy A Car Santander Consumer

What Is Gap Coverage And Why Might You Want It When You Buy A Car What Is Gap Coverage And Why Might You Want It When You Buy A Car Santander Consumer

Post a Comment for "Is It Worth Purchasing Gap Insurance"