Travelers Insurance Federal Tax Id Number

The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format. Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id.

Seattle At Every Checkpoint At Sea Tac International Airport There Is A Sign Warning Travelers That A Washing Drivers License Passport Online Passport Card

Seattle At Every Checkpoint At Sea Tac International Airport There Is A Sign Warning Travelers That A Washing Drivers License Passport Online Passport Card

State or Local Income Tax 3.

Travelers insurance federal tax id number. For an immediate need please call 1-888-661-3938 and select option 3 between the hours of 8am-8pm Eastern Standard Time Monday through Friday. It is a 9-digit number beginning with the number 9 formatted like an SSN NNN-NN-NNNN. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

10-K filing includes an Exhibit 21 subsidiary information. Employer Identification Number EIN. 1029 provides instructions for establishing an exemption from the section 4371 excise tax on insurance premiums paid to a foreign insurer or reinsurer when the exemption is based on the provisions of an income tax treaty to which the United States is a partySection 301 of Rev.

EIN Employer Identification Number An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. 2003-78 provides that a person otherwise required to remit the insurance. Box2408 Rancho Cordova CA 95741-2408 SocialSecurityNumber Payers Federal ID No.

Can anyone give me the arizona federal id number. The insurance companies authorized to do business in New Jersey and their code numbers are listed below. An ITIN or Individual Taxpayer Identification Number is a tax processing number only available for certain nonresident and resident aliens their spouses and dependents who cannot get a Social Security Number SSN.

XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment tax reporting. MS Word doc Rich Text Format rtf PDF format pdf Updated 040121. My client lost his 1099-g for his 2016 refund so please help.

XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment tax reporting. Ask questions get answers and join our large community of tax. The IRS employee will ask the necessary disclosure and security questions prior to providing the number.

Insurance company federal identification number must be entered. I have completed the info to submit my tax returns. Taxpayer identification number but who do not have and are not eligible to obtain a Social Security number SSN from the Social Security Administration SSA.

Generally businesses need an EIN. It is one of the corporates which submit 10-K filings with the SEC. Click on the format you would like to display the codes.

Before I can submit them I get the Check This Entry screen. Employer Identification Number EIN. It states Taxpayers Health Insurance Worksheet.

Ins Co ID number _____. Unemployment Insurance Integrity and Accounting Division - MIC 16A PO. The IRS issues ITINs to individuals who are required to have a US.

You may apply for an EIN in various ways and now you may apply online. Box 2 Amount is for Tax Year4. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.

Simply call 800 829-4933 and select EIN from the list of options. Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id. Once connected with an IRS employee tell the assistor you received an EIN from the Internet but cant remember it.

Unemployment Compensation UC Refunds Credits or Offsets Tax Withheld Type of UC Payments. The employer identification number EIN for Travelers Companies Inc. An Individual Taxpayer Identification Number ITIN is a tax processing number issued by the Internal Revenue Service.

Please check this box if you would also like a copy of this Auto ID card s faxed to you in 1 business day.

Texas Tax Id Format Vincegray2014

Texas Tax Id Format Vincegray2014

What Is Insurance Policy Number Five Things You Won T Miss Out If You Attend What Is Insuran How To Plan Insurance Policy Templates

What Is Insurance Policy Number Five Things You Won T Miss Out If You Attend What Is Insuran How To Plan Insurance Policy Templates

Texas Tax Id Format Vincegray2014

Texas Tax Id Format Vincegray2014

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Texas Tax Id Format Vincegray2014

Texas Tax Id Format Vincegray2014

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Company Confirmation Letter Doctors Note Template Bank Statement

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Company Confirmation Letter Doctors Note Template Bank Statement

Texas Sales Tax Id Form Vincegray2014

Texas Sales Tax Id Form Vincegray2014

Https Www Aig Com Content Dam Aig America Canada Us Documents Investor Relations 2014 Form Pdf

Https Www Uscis Gov Sites Default Files Document Data L1 Approved Petitions Fy2015 12 27 17 Pdf

Medi Share Review 2020 A Low Cost Alternative For Health Insurance Best Health Insurance Health Insurance Coverage Health Insurance

Medi Share Review 2020 A Low Cost Alternative For Health Insurance Best Health Insurance Health Insurance Coverage Health Insurance

Amazon U S Master Tax Guide 2019 Cch Tax Law Editors 9780808047780 Amazon Com Books Tax Guide Tax Ebook

Amazon U S Master Tax Guide 2019 Cch Tax Law Editors 9780808047780 Amazon Com Books Tax Guide Tax Ebook

Health Insurance Plans For Individuals Families Employers Medicare Unitedhealthcare Health Insurance Plans Family Health Insurance How To Plan

Health Insurance Plans For Individuals Families Employers Medicare Unitedhealthcare Health Insurance Plans Family Health Insurance How To Plan

Texas Tax Id Form Vincegray2014

Texas Tax Id Form Vincegray2014

Amazing Way To Take Health Insurance As A Tax Deduction Tax Deductions Health Insurance Deduction

Amazing Way To Take Health Insurance As A Tax Deduction Tax Deductions Health Insurance Deduction

Individual Taxpayer Identification Number Itin Definition Bankrate Com

Individual Taxpayer Identification Number Itin Definition Bankrate Com

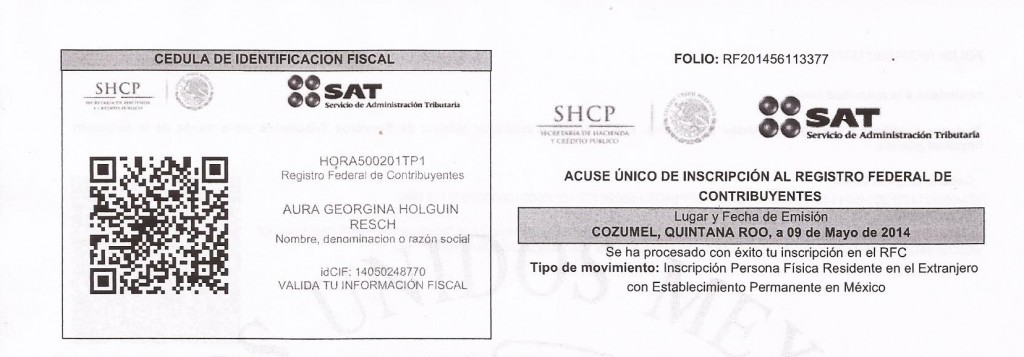

Rfc Tax Identification Document The Cozumel Sun News

Rfc Tax Identification Document The Cozumel Sun News

How Do I Find Out My Filing Status Get Answers To All Your Questions About Taxes More On Our Nifty Tax Guide On 1040 Tax Guide Filing Taxes Tax Help

How Do I Find Out My Filing Status Get Answers To All Your Questions About Taxes More On Our Nifty Tax Guide On 1040 Tax Guide Filing Taxes Tax Help

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Post a Comment for "Travelers Insurance Federal Tax Id Number"